Bitcoin (BTC) has recently rallied to the $72,000 resistance of a 3-month price range and suddenly dropped back to $67,000. This volatility created imbalances in the derivatives market, now weighted toward Bitcoin short-sellers, possibly leading to an impending short squeeze.

Notably, since late February, Bitcoin has kept the $12,000 price range from $60,000 to $72,000. In the meantime, two deviations from the range marked a rally to $73,805 for a new all-time high and a sudden crash to $56,537.

On May 21, the leading cryptocurrency precisely reached $72,000 again, and Bitcoin short-sellers jumped in betting in the pattern. As developed, BTC indeed respected the 3-month range and currently lost 6.4% from this level, trading at $67,315.

BTC/USD, daily price chart. Source: TradingView

However, such activity could make the short-sellers a target, as Bitcoin’s future contracts and leverage trading accumulate liquidations upwards. Should these liquidity pools become a target, BTC could face a short squeeze in the coming days.

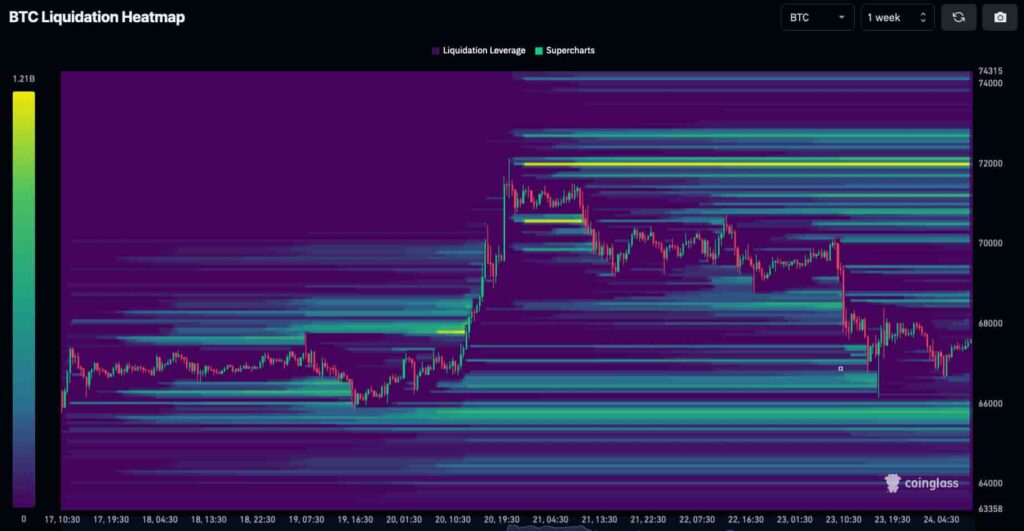

Finbold gathered data from CoinGlass on May 24 to gain insights into the current state of the derivatives market.

In particular, over $1.2 billion of liquidations have accumulated in the $72,000 range resistance. Market makers and professional traders could see this as an opportunity to encounter fuel for a possible range breakout.

BTC Liquidation Heatmap, 1 week. Source: CoinGlass

This is because of the threat of a short squeeze, which would liquidate these short-seller’s positions and create artificial demand, pumping Bitcoin’s price above its current all-time high.

On the other hand, cryptocurrency traders constantly reevaluate their positions as the market changes. Therefore, if traders close their short positions, this reported liquidity pool could no longer exist in the following days.

As a validation of a possible short squeeze, Ali Martinez reported an increased Bitcoin whale activity with a bullish bias. According to Martinez, these whales bought the dip to $67,000 for 20,000 BTC purchased, worth $1.34 billion.

#Bitcoin whales are buying the dip! These large #BTC holders have purchased over 20,000 $BTC in the last 24 hours, worth $1.34 billion, as prices dropped below $67,000. pic.twitter.com/8CNXkhZeZK

— Ali (@ali_charts) May 24, 2024The positive sentiment could propel Bitcoin short-sellers future liquidation as the spot market could face a supply shock. Nevertheless, investors should remain cautious and avoid overexposure to cryptocurrencies, considering their inherent risks and volatility.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk