Amidst the housing crisis in Canada, which has placed significant pressure on aspiring young homebuyers, Prime Minister Justin Trudeau has proposed a new Capital Gains Tax. This tax would range from 50% to 67%, depending on the taxpayer’s income bracket.

The Capital Gains Tax is levied on individuals when they sell an asset or capital property, with capital gains representing the profits from such sales.

According to the Canada Revenue Agency’s website, common capital properties include cottages, securities (such as stocks, bonds, cryptocurrencies, and units of a mutual fund trust), land, and buildings.

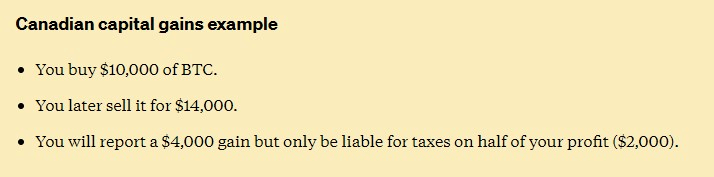

Example of Canada’s Capital Tax on crypto. Source: TokenTax

In Canada, any taxable capital gains must be reported as income on the tax return for the year the stock was sold. The income is typically considered to be 50% of the capital gain.

For instance, if an asset is sold for $2,000 CAD with an adjusted cost base of $1,000 CAD, the taxable income would be $500 CAD ($1,000 gain x 50%). This $500 CAD must be added to taxable income and will be taxed at a marginal tax rate according to the tax bracket.

Under the new Capital Gains Tax law, if the amount exceeds $250,000 CAD, the yearly tax percentage may vary from 50% to 67%.