It has emerged that BNY Mellon, the largest custodian bank globally, is among the latest entities to gather exposure to Bitcoin (BTC) through a spot exchange-traded fund (ETF).

In a Securities Exchange Commission (SEC) filing, the institution revealed its exposure to ETFs from BlackRock (NYSE: BLK), the world’s largest investment firm, and Grayscale.

The bank’s foray into the Bitcoin ETF market potentially signifies the increasing interest in this product. Notably, the United States approved Bitcoin ETFs, with 11 products gaining the nod to start trading. This move partly contributed to Bitcoin’s resurgence, reaching an all-time high of over $73,000 in March.

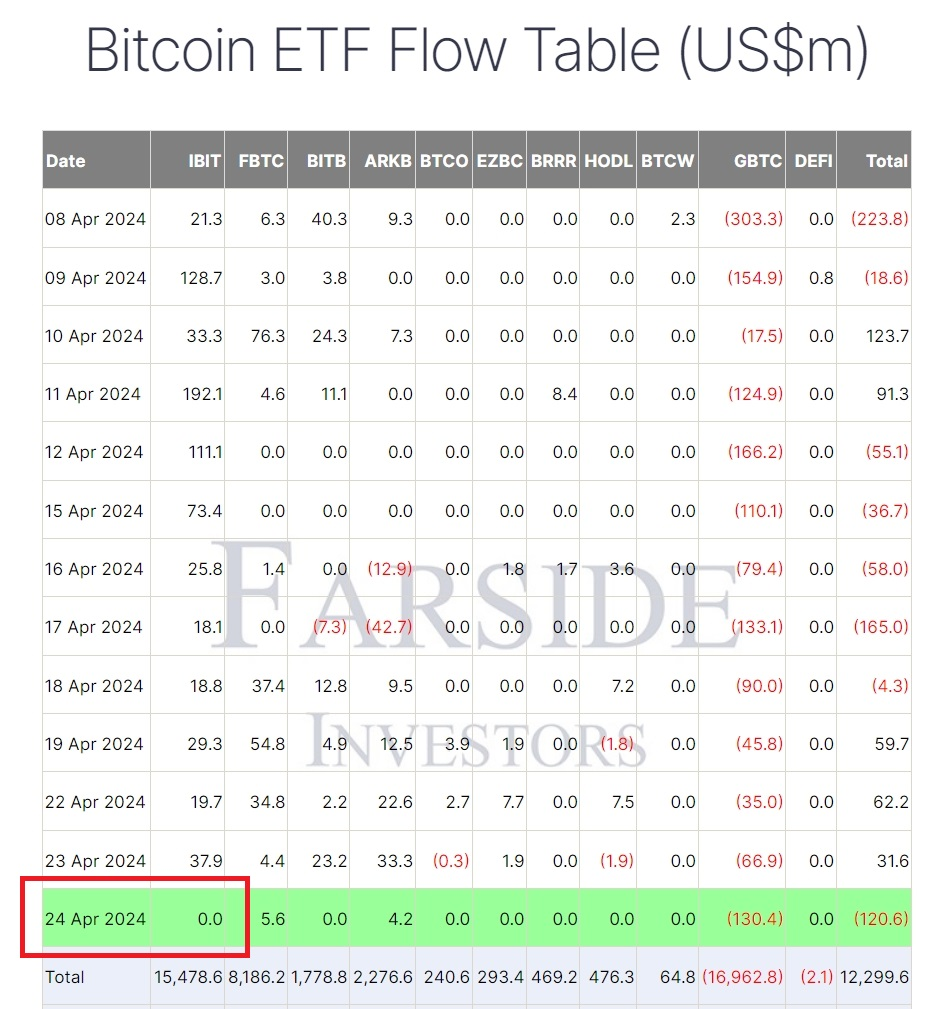

Spot Bitcoin ETF inflow and outflow data. Source: Farside

Overall, BNY Mellon’s involvement underscores the increasing penetration of Bitcoin and crypto products on traditional finance, driven by growing institutional interest. It remains to be seen whether other lenders will follow suit.

Notably, this decision comes when the crypto industry awaits a potential Ethereum (ETH) spot ETF, with BlackRock among the applicants for the product.

Meanwhile, the spot ETF product is expanding globally, with Hong Kong being the latest region to approve the product.

It’s worth noting that BNY Mellon’s exposure to cryptocurrencies is not a recent development. Previously, the bank announced its intention to securely manage, transfer, and facilitate the issuance of Bitcoin and other cryptocurrencies for its asset management clientele.

This decision came after the bank reportedly conducted an internal survey, revealing institutional demand for a scalable financial infrastructure supporting traditional and digital assets.

In the meantime, Bitcoin continues to consolidate trading below $65,000. By press time, the crypto was valued at $64,140, surging by over 1% in the last 24 hours.

Bitcoin seven-day price chart. Source: Finbold

Attention is generally focused on Bitcoin’s next trajectory, as a decline below the $60,000 mark could potentially spell further trouble for the maiden cryptocurrency.