Bitcoin (BTC) completed its fourth halving event, leaving the market anticipating whether this milestone will live up to its historical significance as a bullish anchor moment.

To gain insights into how Bitcoin is likely to trade post-halving, Finbold consulted the Claude 3 Opus artificial intelligence (AI) model from Anthropic, which is viewed as a superior tool compared to OpenAI’s ChatGPT.

Drawing from historical data and the observed effects of previous halvings, Claude AI’s analysis suggested that Bitcoin is poised for substantial price appreciation in the aftermath of this latest event.

Bitcoin price prediction. Source: Claude 3 Opus

The AI’s predictions also factored in the increasing institutional adoption of Bitcoin and prevailing market sentiment. However, the AI model emphasized the importance of caution, warning that price estimates are subject to general market fluctuations.

Amidst the AI tool’s price predictions, Bitcoin has recently experienced increased price volatility, mainly due to geopolitical tensions. However, amid the volatility, the leading cryptocurrency has stabilized its valuation above the $60,000 support zone.

In the interim, analysts have underscored several key factors to monitor as Bitcoin traverses the post-halving landscape. For instance, according to a Finbold report, crypto analyst Rekt Capital noted that the period preceding the halving laid the groundwork for the subsequent phase in Bitcoin’s halving cycle.

This analyst suggested that the low point of this retracement acts as the foundation for re-accumulation before a potential surge in value, characterized by a possible parabolic upside.

As of press time, Bitcoin was trading at $64,619, reflecting a decline of about 1% over the last 24 hours. However, on the weekly chart, BTC has shown an increase of 1.2%.

Bitcoin seven-day price chart. Source: Finbold

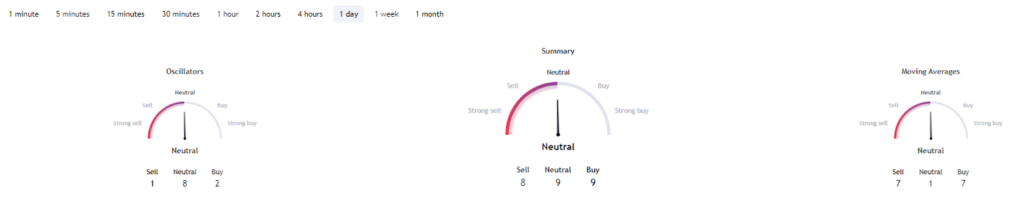

Meanwhile, Bitcoin’s technical indicators are currently neutral. A summary of the one-day gauges retrieved from TradingView indicates a neutral stance, scoring 9. This sentiment is mirrored in moving averages and oscillators, scoring 1 and 8, respectively.

Bitcoin technical analysis. Source: TradingView

In conclusion, as the majority of analyses suggest a bullish momentum for Bitcoin, the focus now shifts to the ability of bulls to stabilize the price above $65,000. This level is expected to serve as a crucial anchor for propelling Bitcoin to new heights.

Disclaimer:The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk